With the addition of these funds the Company is now in a position to plan for the next phases of exploration at its’ USA and South Australian projects. We thank existing and new investors for recognising the significant potential of our uranium and copper portfolio.

The Board looks forward to updating the market in the near future on our exploration and project development plans.- Managing Director Nicole Galloway Warland

HIGHLIGHTS

• The Company has conditionally raised, in aggregate, gross proceeds of A$1.3 million via the placing of 100,000,000 new ordinary shares of 0.01p each (“Ordinary Shares“) (the “Placing Shares“) at a price of 1.3 cents per Ordinary Share (the “Placing Price”), comprising: approximately A$467,890 by means of a firm placing (“Firm Placing“) with certain institutional shareholders of 35,991,508 new ordinary shares (“Firm Placing Shares“) at the Placing Price

- approximately A$832,110 by means of a conditional placing (“Conditional Placing” and together with the Firm Placing “Placings“) with certain institutional shareholders of 64,008,492 new ordinary shares (“Conditional Placing Shares” and Firm Placing Shares being “New Ordinary Shares“) at the Placing Price.

- All placees to receive, one option for each two Placing Shares, to subscribe for a further new Ordinary Share at 2.6 cents expiring in 3 years. All options for both the Firm Placing and the Conditional Placing will be subject to shareholder approval.

• Strong support was received from a broad range of new institutional and sophisticated investors, adding strength to the Company’s share register. Prenzler Group acted as lead manager for the Placement.

• The Company’s Non-Executive Chairman Mr Alastair Clayton to invest A$100,000 in the Conditional Placing, subject to shareholder approval.

• The Company’s Managing Director Ms Galloway Warland to invest A$13,000 in the Conditional Placing, subject to shareholder approval.

• The Conditional Placing is conditional on the Company obtaining the requisite approvals from Shareholders at a General Meeting, details of which the Company will circulate in due course.

ABOUT THOR's

URANIUM-VANADIUM PROJECTS

LATEST

NEWS

Uranium Drilling Commences at Wedding Bell Project

Drilling has commenced at Groundhog Prospect, on the Company’s 100% owned Wedding Bell Project, located in the uranium-vanadium

mining district of the Uravan Mineral Belt, southwest Colorado, USA.

Drill Preparations Underway At Wedding Bell Uranium Project

On-ground drill site preparations are now underway for our 2024 drilling programs at Rim Rock and Groundhog mine areas, with drilling scheduled to commence in early October

Uranium Drill Approvals Granted, Wedding Bell and Radium Mountain Projects, USA

All approvals and permits have been granted to commence follow-up drilling at Wedding Bell and Radium Mountain projects including Rim Rock and Groundhog Prospects

Equity Placing to Accelerate Uranium and Copper Exploration

With the addition of these funds the Company is now in a position to plan for the next phases of exploration at its’ USA and South Australian projects.

RIU – Investor Presentation (May 2024)

Thor Energy Plc is pleased to provide investors with a chance to view the presentation slides from the Investor Presentation titled “Uranium Focus”, prepared by MD Nicole Galloway Warland, for the RIU Conference in Sydney.

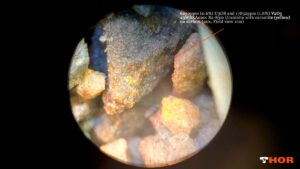

High Grade Uranium and Vanadium Assays – Wedding Bell and Radium Mountain Projects, USA

Assays return up to 3,0348 ppm (3.0%) V2O5 vanadium pentoxide, with uranium assay grades up to 6,250ppm (0.63%) U3O8, consistent with the high-grade downhole gamma uranium results